I am 54 years old, and being in my mid 50s I am very aware of my retirement funds. Each year I look at my retirement funds and reassess how they are allocated. When I started saving for retirement in my early 20’s, retirement seemed so far away. Now it seems to be right around the corner. When I setup my first IRA at age 21, I knew I had years on my side, and I could be aggressive with my portfolio. Now I am pulling back on that stance and building a more conservative mix of investments.

Looking Towards Retirement – Asset Allocation

Experts say that a mix of 60% stocks and 40% bonds is a conventional mix for someone my age. Currently, because I have been willing to take a bit more risk, my asset allocation looks more like 70/30. I am not certain of my retirement date from full-time teaching, but it will be within the next 5 – 7 years. Because of that I am saving more (having kids graduate from college helps with that) and moving to a more conservative mix of investments that includes more income assets. Even though the market has been hot lately – maybe because it has been so hot. I am feeling like I need to be rebalancing to get my portfolio closer to to 60/40 model.

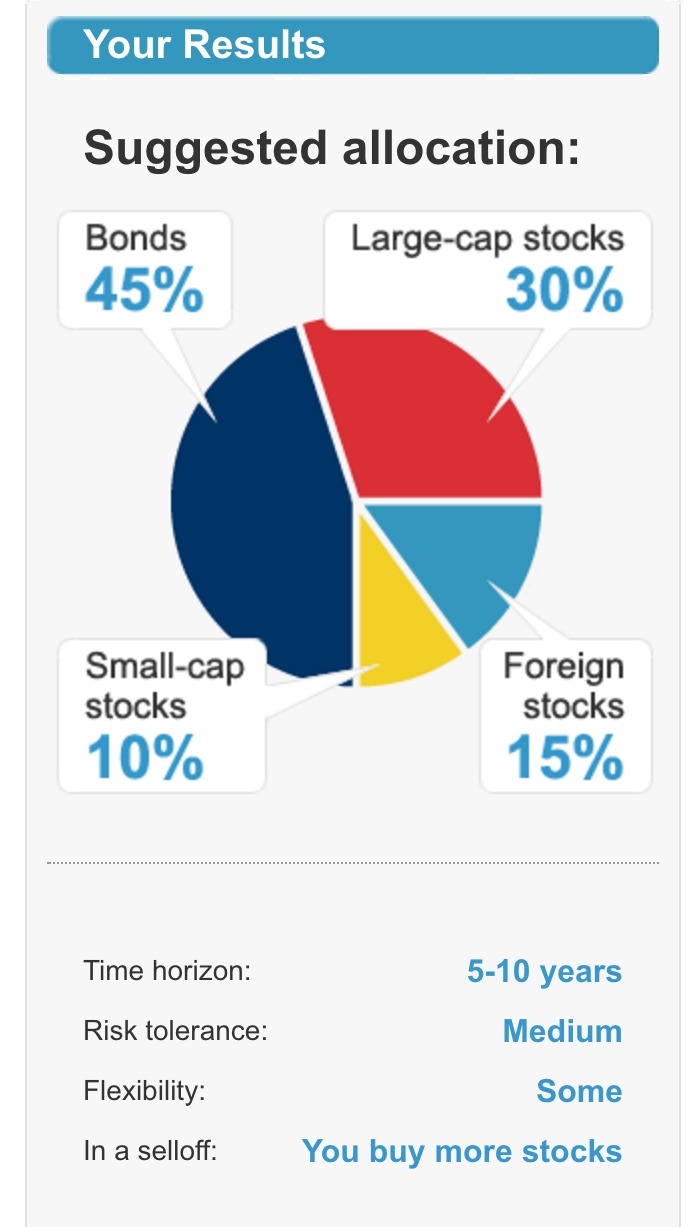

I ran a quick asset allocation calculator, and it came up with a 55% Stocks and 45% bond ratio as a better mix for me.

You can run your own numbers with this quick and easy Asset Allocation Calculator. This really only gives a rough estimate based on four questions.

The key to remember is that asset allocation depends on a number of individual factors such as your age, the number of work years ahead, risk tolerance, income and savings levels, and the big unknown – how many years of retirement need to be funded. This is where having a financial plan is very helpful! As my retirement date is getting closer, I know I am becoming more conservative with and protective of my portfolio. It is important to reassess my portfolio once a year. After all, it is my golden nest egg.

When you think of investments and retirement, what risk level are you comfortable with?