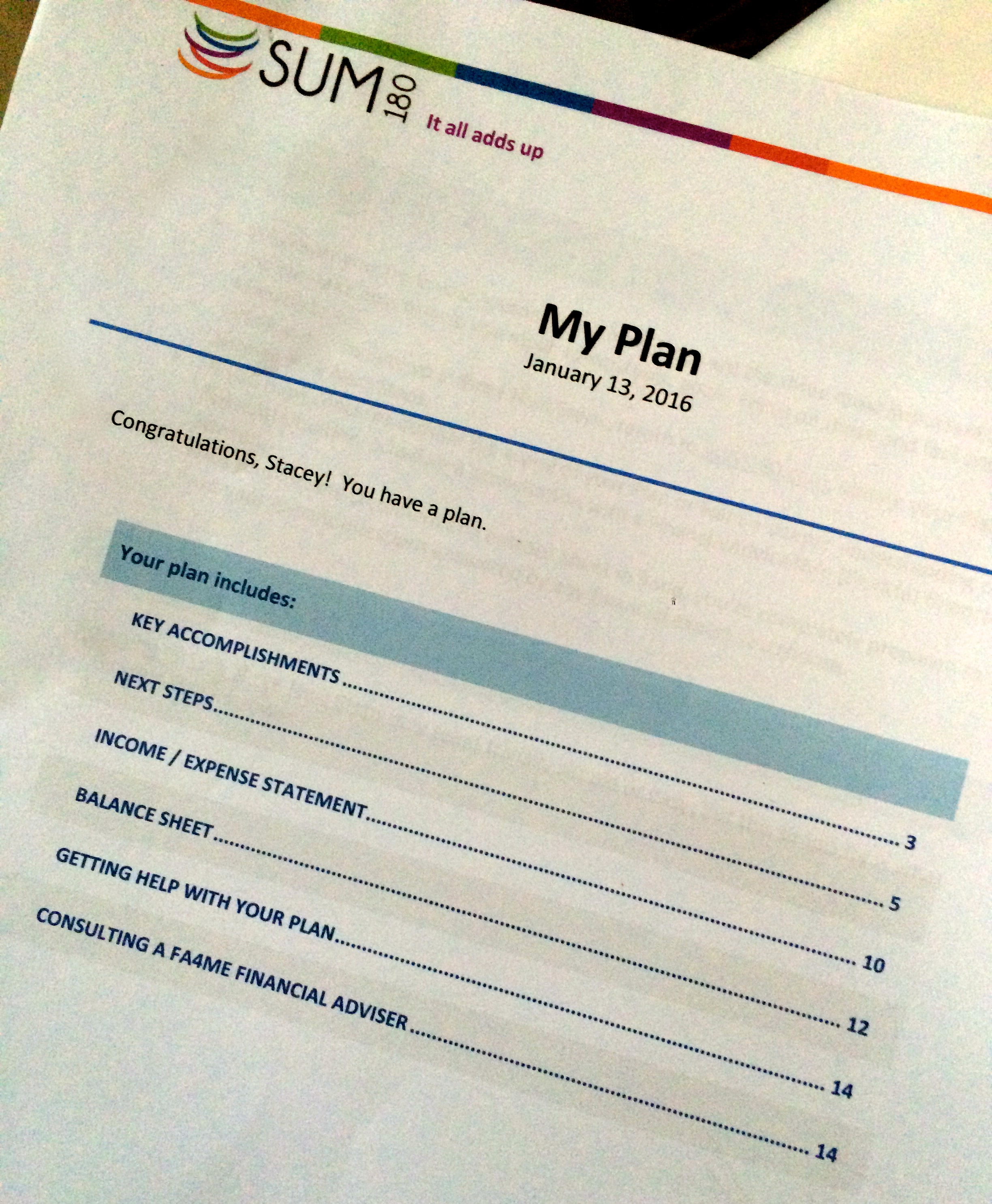

We moved! This past weekend was our moving date. After a summer of trying to make this deal happen – it happened. It seems like the move date came really fast – with a three week close on selling our home, it sort of did. But then again we started getting serious about this process …