Saving money looks different over the course of our lives. When you look at it decade-by-decade, our financial health needs change and grow. When I set up my first IRA at the age of 20, retirement seemed eons away. Now that I am in my 50s it’s looking to be closer and closer. Because I started saving young, I am going to be ready to retire when the time comes. Yahoo!!

When it comes to saving, time and the power of compound interest are on your side. The earlier you start – the better off you will be. Knowing what you are saving for and setting goals is the first step in getting there. You can download a Financial Goal Worksheet from an earlier post of mine titled, Setting Goals: Getting your Financial House in Order.

Our fourth child just graduated from college and will soon be joining the work force on a full time basis. Which means another child is ready to start saving for retirement! While our kids are in their 20s, I am encouraging my children to get started on the right step. My dad was the one that directed me to set up that first IRA when I was still in college, and I am hoping to be that same guide to my own children.

Even my daughter that is planning on attending medical school and is currently working and saving for that giant expense, has set up an IRA. The thought might be that once she is a doctor, the saving for retirement will be easier. Most likely that is true, but there is no reason not to sock away a little bit now. Remember, compound interest is a beautiful thing. Plus this sets up positive financial habits.

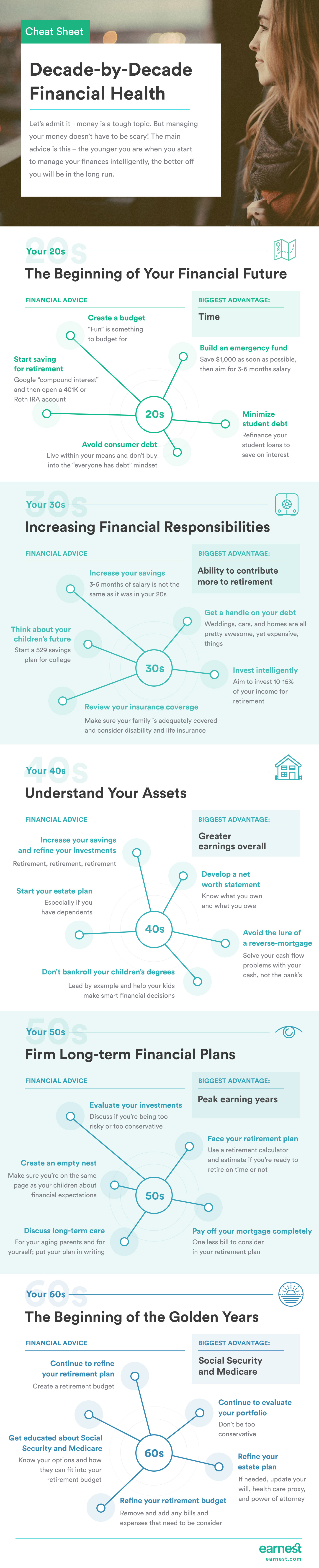

Decade-by-Decade Financial Health

Decade-by-Decade Financial Health

Now matter where you are in your financial journey, sound financial habits will serve you well. I love this graphic that was sent to me highlighting decade-by-decade financial health, so I thought I would share it with you. It succinctly breaks down the goals and advice for each decade of your life. Look where you are and see what your next steps should be.

Being in our 50s, my husband and I have been re-evaluating our investment portfolios looking for the right asset allocation that allows for continued growth but is not too aggressive. We are not empty nesters yet, we still have two children in the home, and this summer there will be three kids with one being home from college. But like I said at the beginning – retirement is getting closer and closer.

Where are you in your financial journey? What are your next steps?

Thank you to the folks at Earnest who created this guide breaking down decade-by-decade on what you should be doing at each age range to set yourself up for financial success. If you’re not familiar with Earnest, they are a company that provides low-interest student loan refinancing and low-cost personal loans.