One of my ongoing projects is to help keep our financial house in order. When I was fresh out of college in 1986, I worked in the financial industry. My degree was in Business Administration and Economics and investing was my passion. I held jobs with Citibank; IDS Financial Services; and Bateman, Eichler, Hill, Richards.

Starting as a bank employee, I then progressed to financial planner (with Series 7 and insurance licenses), and then I worked in a brokerage firm. All of these positions gave me an insider look at how people took care of their finances.

As a bank teller before the age of ATMs, people actually had to walk into the bank to make deposits and withdrawals. I saw who methodically and systematically saved money, I saw the spouses the kept hidden accounts, I saw the spend thrifts cash their weekly paycheck week in and week out.

Then I became a financial planner and was given full overview of many families’ personal and business finances. I will say that as a 24 year old I was often shocked at how little those facing retirement had saved. They would explain to me that they were house rich and cash poor. I didn’t quite see how a fully mortgaged house, even in Blackhawk, was house rich. In my next job at the brokerage house, I learned how larger institutions looked at and managed investing.

All of these positions together gave me a great education into the saving and investing habits of people. I saw what worked and what did not work. I saw that financial planning, and the ability to follow your plan, helps you reach your financial goals. This is the beginning of a series of blogs that I will be posting about putting your financial house in order. I plan on taking you through this process step-by-step and taking baby steps at that. We are all really busy and some of these steps will take a bit of time – time spent pulling together information and organizing your finances. Each new step will be posted on a Tuesday.

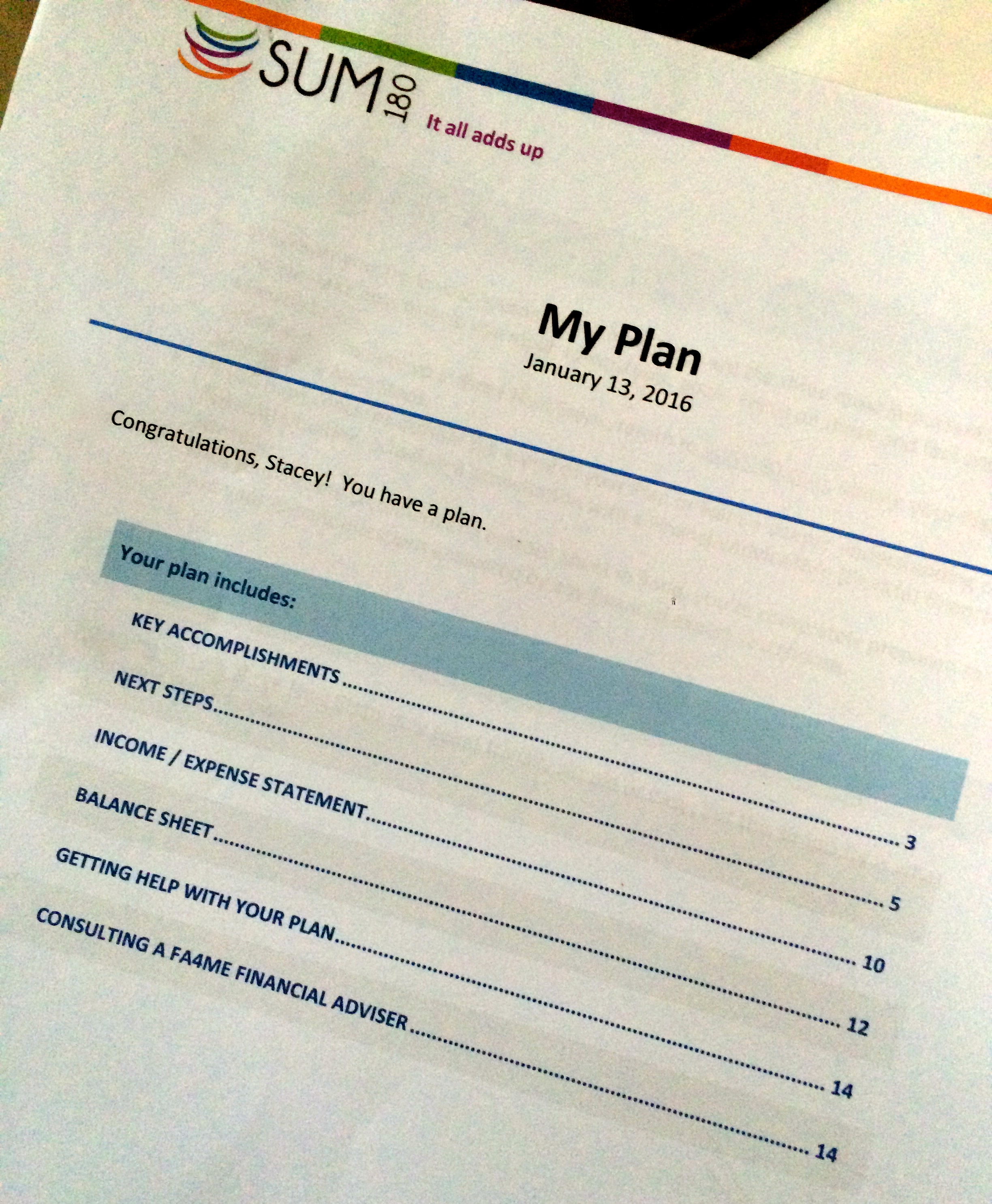

The first step of financial planning is to determine your current net worth. Your net worth is the value of all your assets minus your total debt. You need a starting point. Once you know where you stand financially, you will have the needed information to make better choices. Where do you need to spend your hard earned money? Where do you want to spend your hard earned money? You need to know your net worth before you make other decisions. Plus, once you have a starting point, you will be able to measure your progress.

Step one to putting your financial house in order is to complete the Financial Inventory Worksheet. Don’t think of this as a chore, and don’t let any of the numbers get you stressed. Wherever you are, this is your starting point today. Knowing where you stand is the beginning of controlling your finances.

Click here: Personal Net Worth Worksheet to download your worksheet to get started today!

[…] Get your financial house in order […]

[…] Get your financial house in order […]

[…] financial check-up. Once upon a time, I worked as a financial planner and the habit of tracking my net worth (no matter the numbers), planning for retirement, and revamping a budget, are practices that I […]